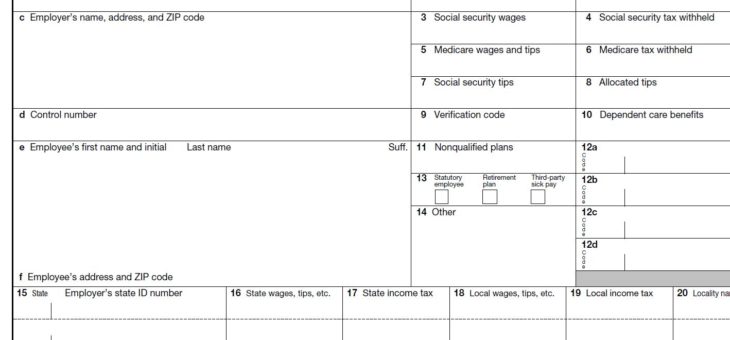

Here’s what you can do if you do not receive your W2 past February

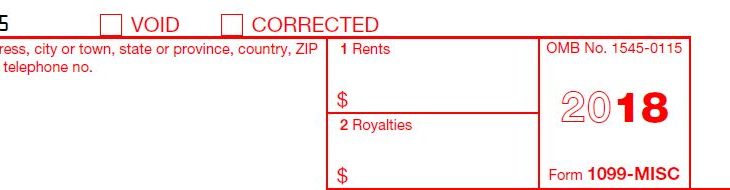

***The below guidelines are applicable if you have not yet received your original W2 or a corrected W2 has not yet been received by the tax filing deadline. Most employers would have already mailed out W2 forms to their employees. If your employer is out of business or if you did not receive your W2Read more about Here’s what you can do if you do not receive your W2 past February[…]