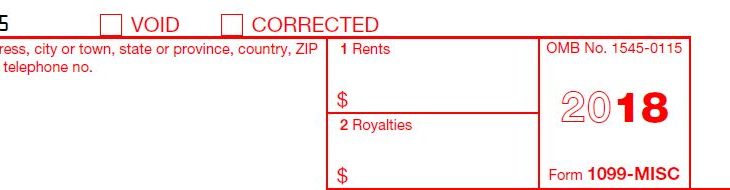

When will I receive tax refund check? IRS refund schedule 2018

IRS refund schedule 2018 One of the most frequently asked questions during the tax season to a tax preparer is ‘ when will I receive a tax refund check’. While the processing times may vary, IRS has issued general guidelines on refunds. It is usually 21 days from the date it is received. ForRead more about When will I receive tax refund check? IRS refund schedule 2018[…]